January 2017: Consulting Market Update

Consulting M&A Activity and Equiteq Consulting Share Price Index Performance

By Ramone Param, Associate Director, Market Intelligence & Buyer Coverage, Equiteq.

The New Year commenced with some notable deal activity and M&A news across all five of the consulting segments that we track. The share prices of many listed consultants that form part of our Equiteq Consulting Share Price Index also rose on the back of strong market sentiment and earnings announcements.

WS Atkins and CH2M $4bn merger talks

The Times reported that British engineering and design consulting firm, WS Atkins Plc (ATKW.L) and US-based CH2M are in merger talks. Atkins had said last year that plans by the new U.S. administration and U.K. government to increase infrastructure spending would benefit the company. Atkins had been using M&A to selectively increase its geographic footprint and capabilities, in a segment that is considered to be consolidating as players look to reduce overheads and increase global market share.

Aon close to $4.5bn sale of benefits outsourcing unit

It was reported by Reuters that Aon Plc is in talks to sell its employee benefits outsourcing business to private equity firm Clayton Dubilier & Rice, who prevails over investment firm, Blackstone, in an auction for the business. The sale will reverse most of Aon’s acquisition of Hewitt Associates for $4.9bn in 2010 and will leave the business focused on insurance and risk management.

Gartner to acquire CEB for $2.6bn

Gartner, Inc. (NYSE: IT) announced that it would be acquiring CEB Inc. (NYSE: CEB), valuing the equity of the business at $2.6 billion. The transaction is worth a total enterprise value of $3.3bn, including Gartner’s assumption of approximately $0.7bn in CEB net debt. The deal implied a c.3.6x FY 2015 revenue valuation multiple and a c.13.6x FY 2015 EBITDA valuation multiple.

The transaction combines Gartner’s research and advisory services in IT, marketing and supply chain with CEB’s talent management insights to provide their clients with a comprehensive set of end-to-end solutions. The deal is an important transaction that exemplifies new areas of convergence between buyers in complementary consulting segments.

Equiteq advises P2 Consulting on MBO led by Lonsdale Capital Partners

In January, Equiteq was pleased to announce that it advised its client P2 Consulting on a management buyout led by the existing management team and supported by Lonsdale Capital Partners. London headquartered P2 provides senior project management support to international blue-chip clients that are undertaking significant change initiatives. Equiteq acted as exclusive financial advisor to P2 Consulting.

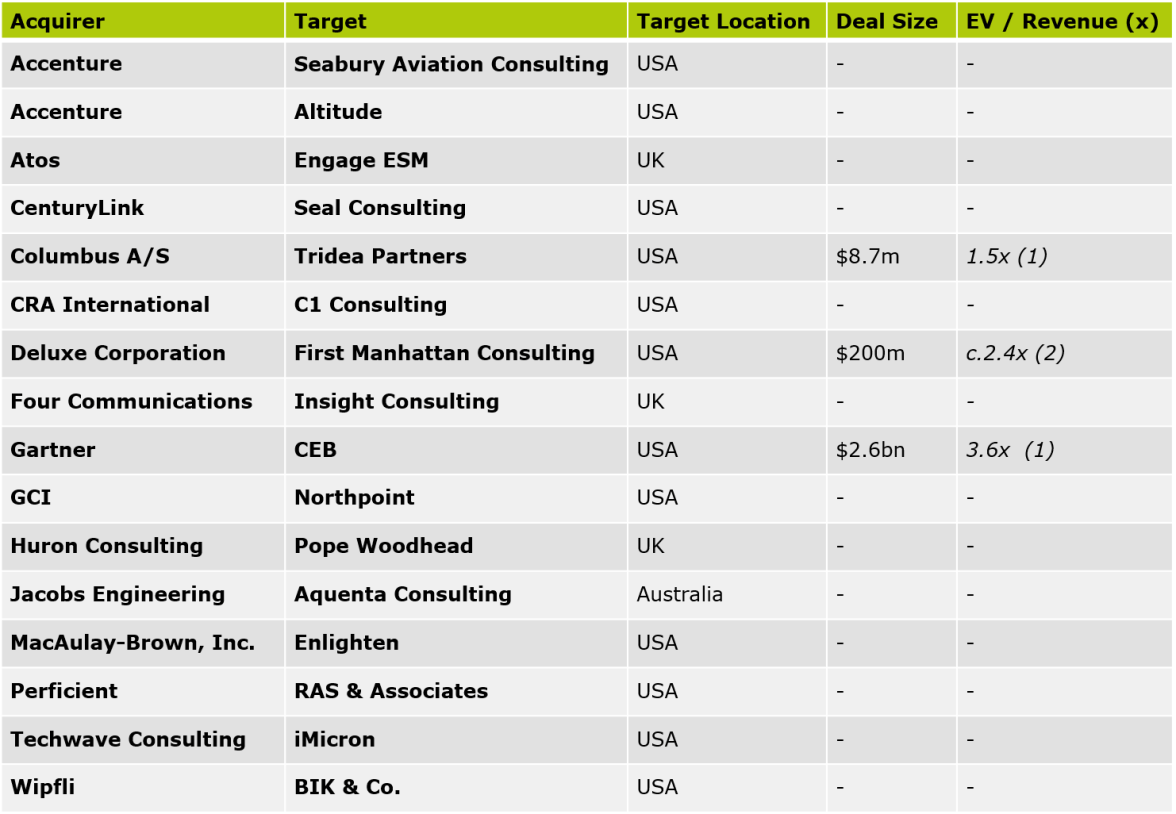

Selected Consulting M&A Deals Announced in January:

Note 1: Based on FY 2015 revenue.

Note 2: Based on 2017 projected revenue.

Important Notice: This article has been compiled using our daily activities in the industry that provide us with unique market intelligence, along with various third party information sources. Valuation metrics in italics are rumoured and have not been confirmed with company press releases.

Are you a member of Equiteq Edge? It’s full of content to help consulting firm owners prepare for sale and sell their business. Register here to gain full access.