February 2020: Knowledge Economy M&A and Equity Market Update

- Major deals profiled include Stone Point Capital and Further Global Capital Management’s acquisition of Duff & Phelps, CGI Group’s purchase of Meti and ICF’s acquisition of Incentive Technology Group.

- Equiteq advised The Shelby Group on its sale to WestView Capital Partners and Choice Financial Solutions on its sale to Raisin.

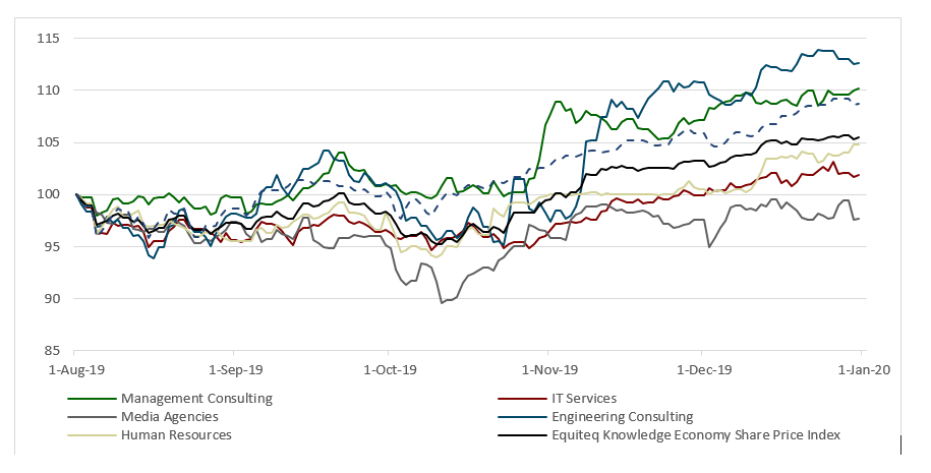

- The Equiteq Knowledge Economy Share Price Index rose over the month.

Duff & Phelps receives fresh investment from Stone Point Capital and Further Global Capital Management.

Target: Duff & Phelps is a US-headquartered provider of valuation, corporate finance and regulatory consulting services.

Buyers: Stone Point Capital and Further Global Capital Management are US-headquartered providers of investment capital.

Deal value: $4.2bn

Deal insight: Duff & Phelps has received fresh capital from Stone Point Capital and Further Global Capital Management to enable the next phase of its growth. Duff & Phelps has c.3,500 professionals located throughout offices in the Americas, Europe and Asia. The firm’s longstanding client relationships include nearly 50% of the companies in the S&P 500, 65% of Fortune 1000 companies and 70% of top-tier private equity firms, law firms and hedge funds.

Permira continues to hold a significant stake in the business as part of the consortium. Permira had acquired Duff & Phelps from Carlyle at the end of 2017. The deal valued Duff & Phelps at $1.75bn, implying a c.2.5x valuation multiple on FY16 revenue. The acquisition marked Permira’s eighth investment in the financial services industry and netted Carlyle 2.4x its investment, according to a report from The Wall Street Journal. During the hold period, Permira was able to partially enable the growth of the business through organic initiatives and also through acquisitions including Kroll in 2018 and Prime Clerk in 2019.

CGI Group acquires French retail solutions provider Meti.

Target: Meti Logiciels et Services (Meti) is a France-based provider of integrated business solutions and consulting services specializing in the retail sector.

Buyer: CGI Group is an IT services company headquartered in Canada.

Deal insight: The acquisition of Meti adds c.300 professionals with significant digital transformation expertise in the retail sector. There is strong demand among IT services and media agency buyers for capabilities focused on the retail sector as exciting digital customer experience advancements disrupt the sector. Meti’s capabilities support retailers across their entire value chain, from supply chain management to in-store commercial operations. The business has particularly strong capabilities in driving retailer’s digital transformation initiatives. CGI will benefit from Meti’s experience of working with notable retail clients like Carrefoure, Leader Price and Metro. The capabilities will also be synergistic with CGI’s cloud-based platform Retail Xp360, which enables retail and consumer services organizations to overcome challenges and deliver value.

ICF acquires Incentive Technology Group adding cloud-based platform services serving the U.S. federal government.

Target: Incentive Technology Group (ITG), a US-based digital consulting firm for government and commercial clients.

Buyer: ICF is a US-based provider of consulting and technology services.

Deal value: $255m (2.8x TTM December 2019 revenue)

Deal insight: ICF’s acquisition of ITG adds 350+ consultants offering significant cloud-based platform services to the U.S. federal government. According to ICF, IT modernization and cloud together is estimated to be a c.$21bn federal market, which ICF already has built capabilities in through organic expansion. ITG works with complementary clients of ICF including the Department of Health and Human Services, the Department of State, the Department of Homeland Security and the General Services Administration.

ITG was also named ServiceNow’s 2019 “U.S. Federal Partner of the Year” and is the second largest ServiceNow partner in the public sector, while also having the largest Appian federal practice in North America. Despite exceeding $4bn in annual revenue, ServiceNow continues to grow at a stellar rate as it broadens its capabilities for customer’s digital transformation initiatives.

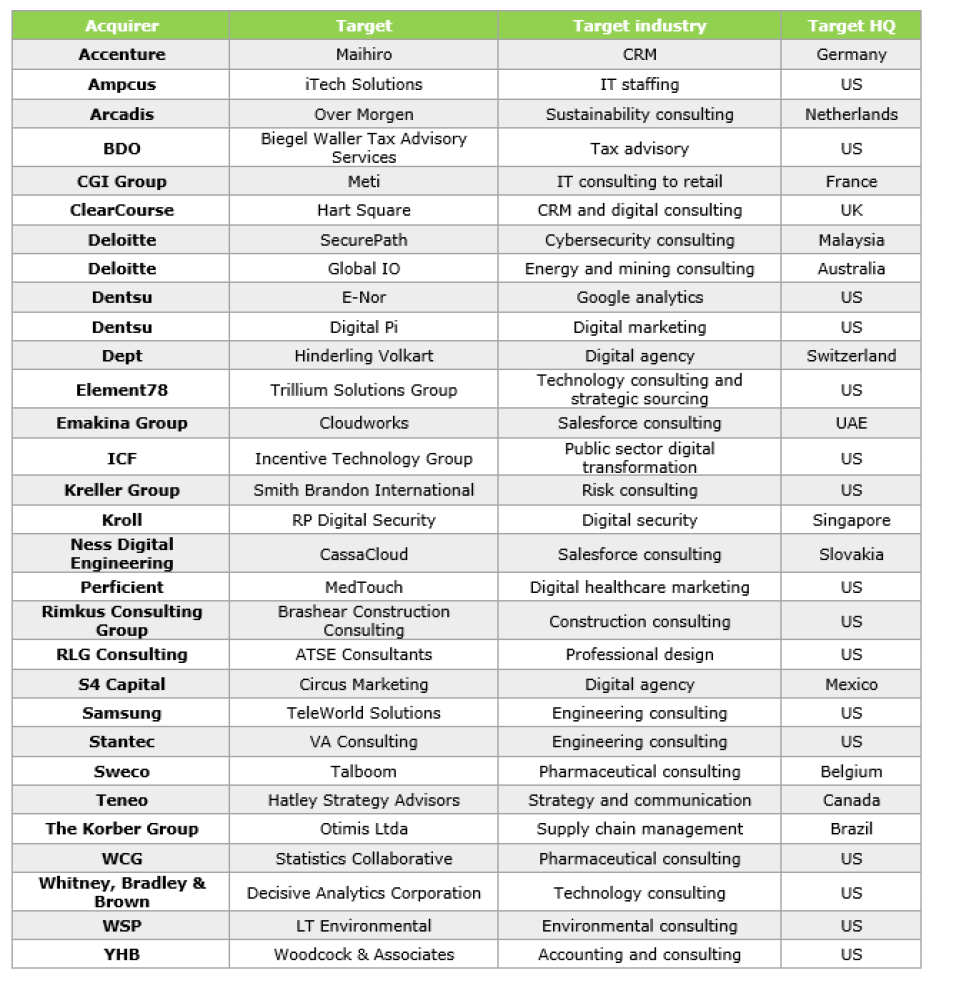

Selected Knowledge Economy M&A announced in January:

Knowledge Economy Share Price Index:

Note: The Equiteq Knowledge Economy Share Price Index is the average of Equiteq’s five segmental indices and is the only published share price index which tracks the listed companies within the knowledge economy. The index is continually revised to consider new listed companies and to remove businesses that are no longer relevant in each quarter.