March 2020: Knowledge Economy M&A and Equity Market Update

- Major deals profiled include KPMG’s acquisition of Wirefire Creative, Capgemini’s purchase of Advectas, and McKinsey’s acquisition of Orpheus.

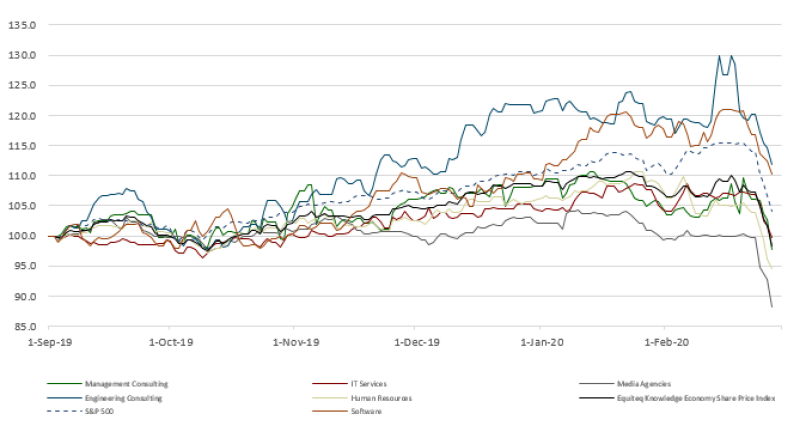

- The Equiteq Knowledge Economy Share Price Index dipped with broader equity indices over the month.

KPMG Canada acquires ServiceNow Partner Wirefire Creative.

Target: Wirefire Creative is the ServiceNow practice of the Canadian technology consultancy Wirefire.

Buyer: KPMG is a global accounting and business advisory firm.

Deal insight:

The deal will add 20 Wirefire professionals to KPMG Canada’s IT advisory team. The team will add strategically important capabilities in ServiceNow consulting, which are enabling many of KPMG’s blue-chip clients’ digital transformations. Wirefire’s Creative co-founder and CEO Karsten Hiemstra will join KPMG as a partner in the firm’s IT Advisory practice and lead its ServiceNow practice in Western Canada.

Despite exceeding $4bn in annual revenue, ServiceNow continues to grow at a stellar rate as it broadens its software solutions. KPMG is a Platinum ServiceNow Partner and was named Americas Partner of the Year 2019 and Americas Transformation Partner of the Year 2020. KPMG is undertaking a multi-year investment program focused on combining KPMG’s deep industry expertise with expertise in technology ecosystems like ServiceNow, as well as Workday, Salesforce, Amazon Web Services, Google Cloud, IBM, Microsoft, Oracle and Alibaba Cloud.

Capgemini acquires Advectas to bolster its business intelligence and data analytics services.

Target: Advectas is a Sweden-headquartered business intelligence and data science company.

Buyer: Capgemini is a France-headquartered technology and digital transformation consulting firm.

Deal insight:

Capgemini’s acquisition of Advectas will add a team of over 200 people with business intelligence and data analytics services capabilities. Advectas works across multiple industry sectors and providers business intelligence solutions across the data value chain. This includes data management and data science services, data analytics consulting, planning and simulation.

The purchase of Advectas comes shortly after Capgemini purchased Purpose, a 100-person social impact firm based in the US. It also follows Capgemini’s milestone purchase of Altran last year. Capgemini’s deal flow in the consulting space is enabling the growth of Capgemini Invent, which combines the legacy Capgemini Consulting business with expertise in technology and data science. The new brand merged prior notable digital acquisitions including the purchase of digital consulting firm LiquidHub, innovation consulting firm Fahrenheit 212, as well as creative design agencies Idean, Adaptive Lab and Backelite. The growth of Capgemini Invent is better positioning Capgemini against growing digital transformation competitors like Accenture, Cognizant and the Indian IT services players.

McKinsey purchases Orpheus, building its digital procurement and spend intelligence capabilities.

Target: Orpheus, a Germany-headquartered developer of software that helps organizations optimize their external expenditure by analysing purchasing data streams.

Buyer: McKinsey is a US-headquartered global management consulting firm.

Deal insight:

McKinsey’s purchase of Orpheus will enable a new offering to McKinsey’s clients called Spend Intelligence by McKinsey. The service will provide spend transparency, spend and cost analytics, as well as value-capture management. Spend Intelligence combines Orpheus’ advanced platform technology with McKinsey’s industry expertise and digital procurement services. Orpheus had previously received investment from KfW Group, Senovo and Unternehmertum Venture Capital Partners.

McKinsey has historically focused on organic growth, while making selective acquisitions in strategically important spaces. Strategic sectors have included digital consulting and data analytics, which are also market segments with acute talent shortages. McKinsey’s acquisitions are typically preceded by a partnership with a target company, which can enable the testing of synergies before agreeing a deal.

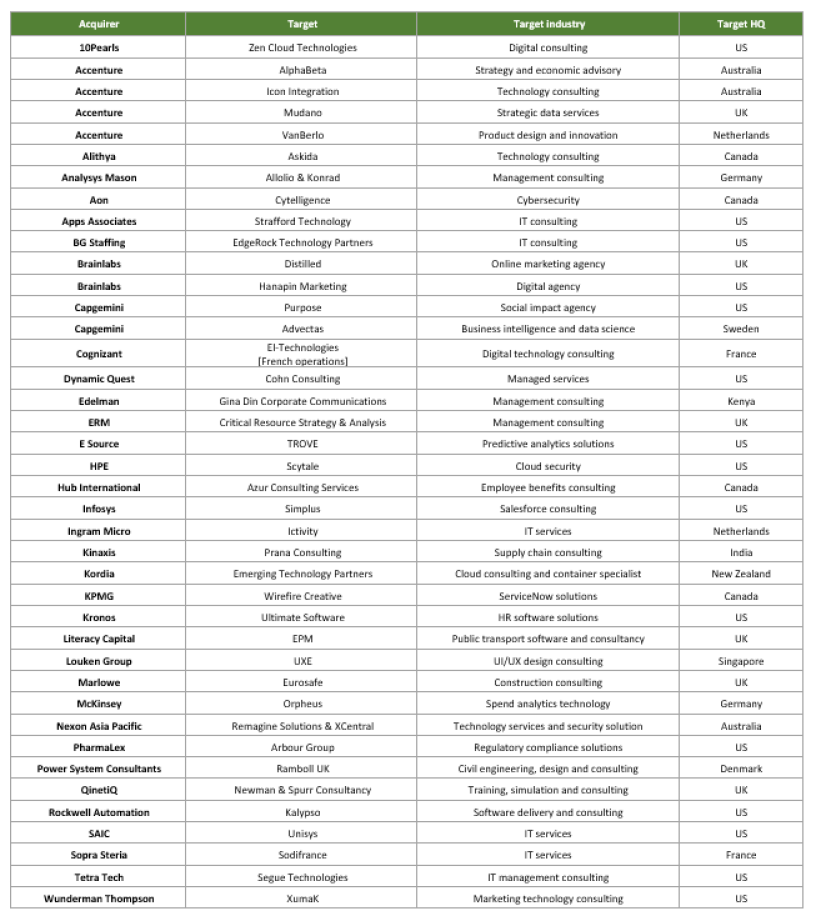

Selected Knowledge Economy M&A announced in February:

Knowledge Economy Share Price Index:

Note: The Equiteq Knowledge Economy Share Price Index is the average of Equiteq’s six segmental indices and is the only published share price index which tracks the listed companies within the knowledge economy. The index is continually revised to consider new listed companies and to remove businesses that are no longer relevant in each quarter.