Monthly Update – M&A Dealflow and Share Prices Increasing Despite Uncertainties

Last week, a well-known UK retailer tweeted, “A customer has just bought a 2021 calendar. Sir, we admire your optimism.”

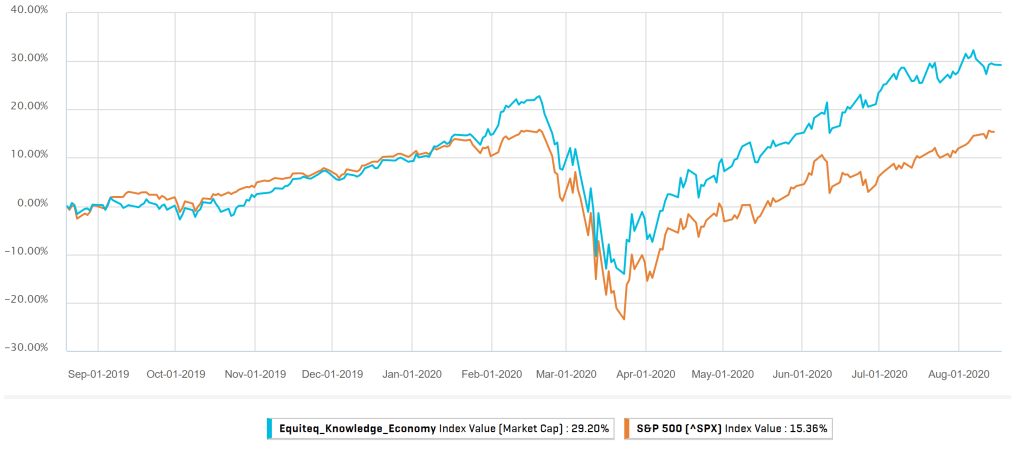

A neat encapsulation of how uncertainty across health, economic and political landscapes continues to shape 2020. And yet: stock markets continue to climb the wall of worry, driven by technology and – increasingly – knowledge economy stocks, while commentators continue to walk back from their worst-case forecasts for both the pandemic and its financial impacts.

As early as the start of May, our team started to observe positive signs in knowledge economy M&A markets. Already, after a short hiatus, existing deals were continuing, buyers and investors were already back in the market, and owners of resilient business were still pro-actively considering their exit options.

This momentum has translated into deal completions over the summer, with four Equiteq deals closed since the end of June, including:

- Advising 4C, a leading Salesforce multi-cloud partner in Europe and the Middle East with over 350 employees, on its acquisition by Wipro – continuing the trend of consolidation in the Salesforce ecosystem, and illustrating Equiteq’s leading position advising on transactions in the digital transformation space

- Providing advice to SIA Partners on their acquisition of Pathfinder, a leading change and transformation consultancy, as SIA continues their journey to strengthen their presence in UK and Ireland, and build a leading Tier-1 independent consulting firm

- Advising Water Street Partners, a leading joint venture and alliance advisory firm, on their sale to Ankura, continuing Ankura’s push to establish itself as one of the leading global consulting firms. Our client’s comment neatly sums up the last few months: “It is hard to imagine the Equiteq team delivering a deal under more difficult circumstances. The COVID pandemic was breaking out as we signed the LOI … the team steered us through tremendous uncertainty with dogged persistence, extraordinary effort, real creativity, and integrity.”

- Advising on a cross-border deal in S.E. Asia – details embargoed until September: more to come

It continues to be our view that the large pool of investors/buyers in market is not seeing adequate deal flow of high-quality acquisition targets like these. Owners of firms that are positioned to be among the early waves of new deals to come to market will meet this pent-up demand and may command a market premium.

Despite this, our community of owners continues to have reservations. In late July, we surveyed owners on their attitudes to M&A. You can download the report at the bottom of this post (or here). Key observations include:

- By far the biggest concern owners had about M&A post-Covid is the prospect of achieving a valuation that reflects the true value of their business

- Most owners are pessimistic about the strength of the economic recovery, and / or have seen detrimental impacts on their trading (although relatively few reported a strong negative impact)

- Most of you don’t believe the worst of the health emergency is over

It’s probably worth re-stating that in current deals, to date, we have seen minimal impact on headline valuations – negotiations have centred primarily on deal structure (e.g. earn-outs not starting until six months after signing)

You might draw a tentative conclusion from the above that owners would delay their M&A process – but over half of those we polled are not delaying their plans. Perhaps one reason for this is – as a small but increasing numbers of owners told us – that the uncertainty and risks of delaying a deal outweigh the perceived benefits. Moreover, from conversations with the buyer community, we hear that, while the quantity, or even the overall quality, of bids and interest may have suffered in some processes, the knock-out offer is still there, at the same high value that might have been anticipated pre-pandemic.

Do get in contact with us if you’d like to talk through any of our recent deals and our latest thoughts on market trends – in particular, on valuations and deal structures.

In the meantime, an update on the Knowledge Economy Share Price Index. We’ve seen our index continue its recovery from March lows, easily outperforming the S&P 500, reflecting the importance of our sector to economic growth, and the increasing application of technology within sector firms.

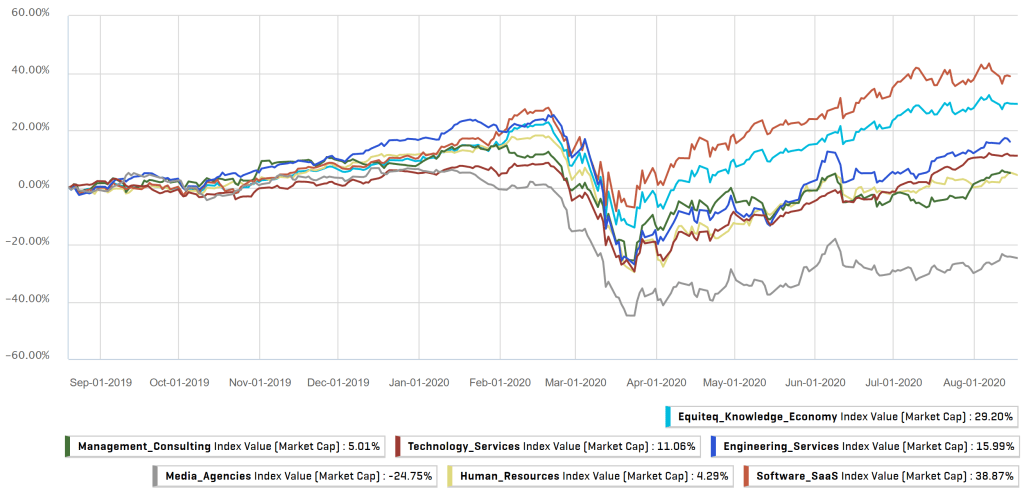

The only sub-sector still down on a 12-month basis is “Human Resources”, which directly mirrors what we saw in our survey. A ray of hope there though – we’re seeing some training, leadership development and recruitment businesses with positive momentum (especially ones with some tech-enablement behind them). It could be a sector that benefits very strongly from a rebound as end clients scale up their investment in people and workforce transformation post-pandemic.

Knowledge Economy Share Price Index vs. S&P 500:

Knowledge Economy Share Index – Sub-Sectors:

Source: S&P Capital IQ

Note: The Equiteq Knowledge Economy Share Price Index is the average of Equiteq’s six segmental indices and is the only published share price index which tracks the listed companies within the knowledge economy. The index is continually revised to consider new listed companies and to remove businesses that are no longer relevant in each quarter.