How long will the spikes in Knowledge Economy M&A activity last?

Following in the wake of the Knowledge Economy's blazing hot market activity in Q1 2021, Q2 had a lot to live up to. The persistence of strong tailwinds (that have barely faltered since Q3 last year) means that M&A activity in the Knowledge Economy has continued apace, with high deal volumes and, arguably, even higher multiples in some segments.

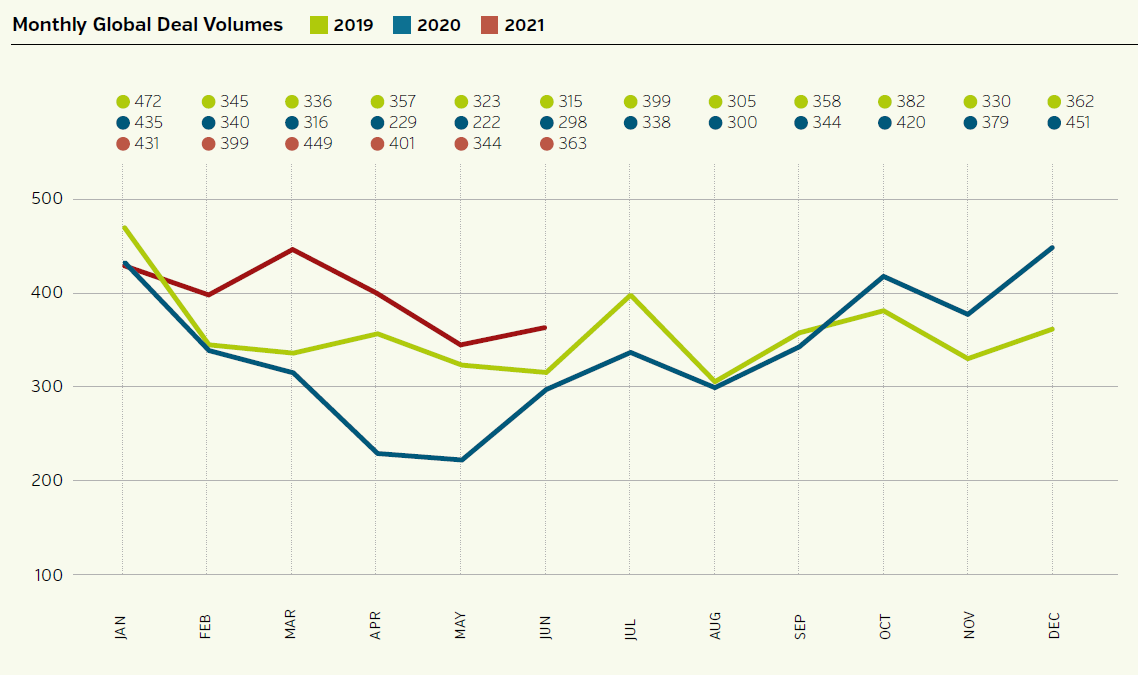

Quarterly deal volumes clearly represent a return - at least in terms of M&A activity - to sustained normality. Q2 2021 is tracking well above comparable quarters for both 2020 and 2019. We have seen 48% more deals completed compared to last year (up from 749 to 1,108), while 2021 is also tracking 11% above 2019 levels of Q2 activity, which saw 995 deals completed. Whilst there has been a 13% drop in deal count in Q2 compared to Q1, this follows the same seasonal pattern of activity we have observed over the last few years.

We have seen the valuation pendulum swing even further in sellers’ favour as plentiful dry powder among buyers, increasing stock market indices and low interest rates enable ever greater spending on higher multiples. Our figures indicate that the Q2 2021 cumulative deal value surpassed Covid-impacted Q2 2020 by 172%. We have also seen a greater proliferation of larger deals in recent months, with deals above $10bn representing 19% of the aggregate deal value in Q2. No deals of this size were reported in the Knowledge Economy Sector during Q1.

Across the sector, deal geography has remained fairly consistent, with domestic deals on average representing 68% of all deals across the Knowledge Economy. Among the sub-sectors of the Knowledge Economy, we can see subtle variations despite an adherence to the broader sector trends. While deal volume and transaction values both dropped slightly from Q1 to Q2 in areas such as HCM and Management Consulting, we’ve seen huge leaps in buyer investment across the IT Services sector, which saw aggregated deal valuations jump by more than 96%, up from $4.5bn in Q1 to a mammoth $8.8bn in Q2.

Such activity reflects the geographic trends we have observed across the quarter, with big spikes in activity across both Europe (double the number of deals IT Services deals y-on-y) and North America (almost double the number of Software deals y-on-y).

Ultimately, Q2 2021 has continued where Q1 left off with activity and valuations both tracking higher than they have done for a number of years. However, despite plentiful dry powder among buyers and a persisting convergence of favourable market conditions, attention must now turn not just to Q3 and Q4, but to 2022.

With the prospect of legislation, inflation, and potential tax raises, on the horizon, it remains to be seen just how long such spikes in M&A activity might persist.

Download the full Q2 2021 Knowlege Economy M&A Report for insight into the M&A activity & trends in the following sectors:

- Software & Tech-enabled Services

- Technology Services & Outsourcing

- Management Consulting

- Engineering Consulting & Services

- Human Capital Management

You may also be interested in our Consulting & Digital Quarterly Report Q2 2021. You can download it here >>