Private equity drives deals for Adobe and Salesforce partners

M&A volumes across the ecosystems of Adobe and Salesforce held steady in 2022, when other market segments endured a steep decline. New global studies of both suggest that heightened private equity interest will see deal rates maintain higher levels in the coming year, too.

Equiteq is an international provider of strategic advisory and M&A services to consulting firms and the broader knowledge economy. Supporting major transactions around the world, across the industrial gamut, the firm has amassed insights into a raft of specialist deals segments.

One such segment is for partners of the Adobe ecosystem. While the software giant has historically specialized in tools for content creation and publication – with flagship products including Adobe Photoshop image editing software; Adobe Illustrator vector-based illustration software; Adobe Acrobat Reader and the Portable Document Format (PDF) – Adobe has been adapting its offering in recent years, opening up new markets. As well as its Adobe Creative Suite bundle leading to a subscription software-as-a-service offering named Adobe Creative Cloud, the company has also expanded into digital marketing software, and is now considered one of the top global firms for Customer Experience Management (CXM).

Amid a tightening economy, marketing departments are having to do more with less, and so effective CXM offerings have become more important than ever. As demand for CXM software grows, so does the demand for partners within Adobe’s ‘ecosystem’, well positioned to help clients get the most out of its software.

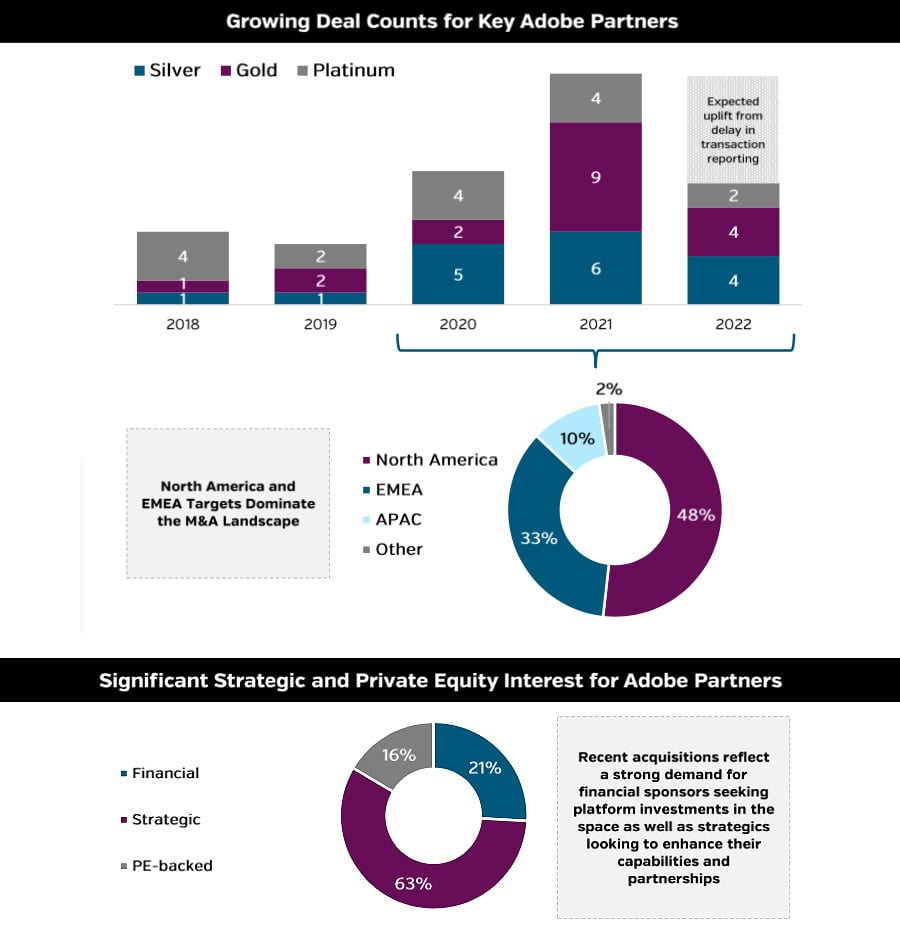

According to Equiteq's Adobe Ecosystem Report, this is driving sustained M&A activity within the Adobe ecosystem. While delayed transaction reporting currently suggests that there was a fall from 2021’s record level of 19 global transactions, the 10 confirmed for 2022 are likely to rise by nine when reporting finally catches up. Looking ahead, Equiteq suggests that the segment’s fundamentals mean it may continue to defy the trends of the broader M&A market in this way.

Thanks to the perceived importance of their services, Adobe partners have remained resilient in the face of economic uncertainty – and continued to trade at healthy multiples through the last 12 months. Relative share prices for key partners rose at around 50% through 2022, while Adobe shares surpassed 100% growth at various points in the year. As a result, there is heightened strategic and private-equity interest in Adobe partners. High private equity activity is one of the key differentiators between M&A markets which are currently outperforming the wider market.

Equiteq predicts a similar outlook for the Salesforce ecosystem in their recent report. Salesforce is a cloud-based software company, providing customer relationship management (CRM) software and applications focused on sales, customer service, marketing automation, e-commerce, analytics, and application development. Again, this is a line of work that is becoming crucial to firms looking to ride out the current economic uncertainty – as CRM solutions can help keep track of contacts within a business, to allow both sales and marketing teams to personalize communication to maintain customer loyalty or win new clients.

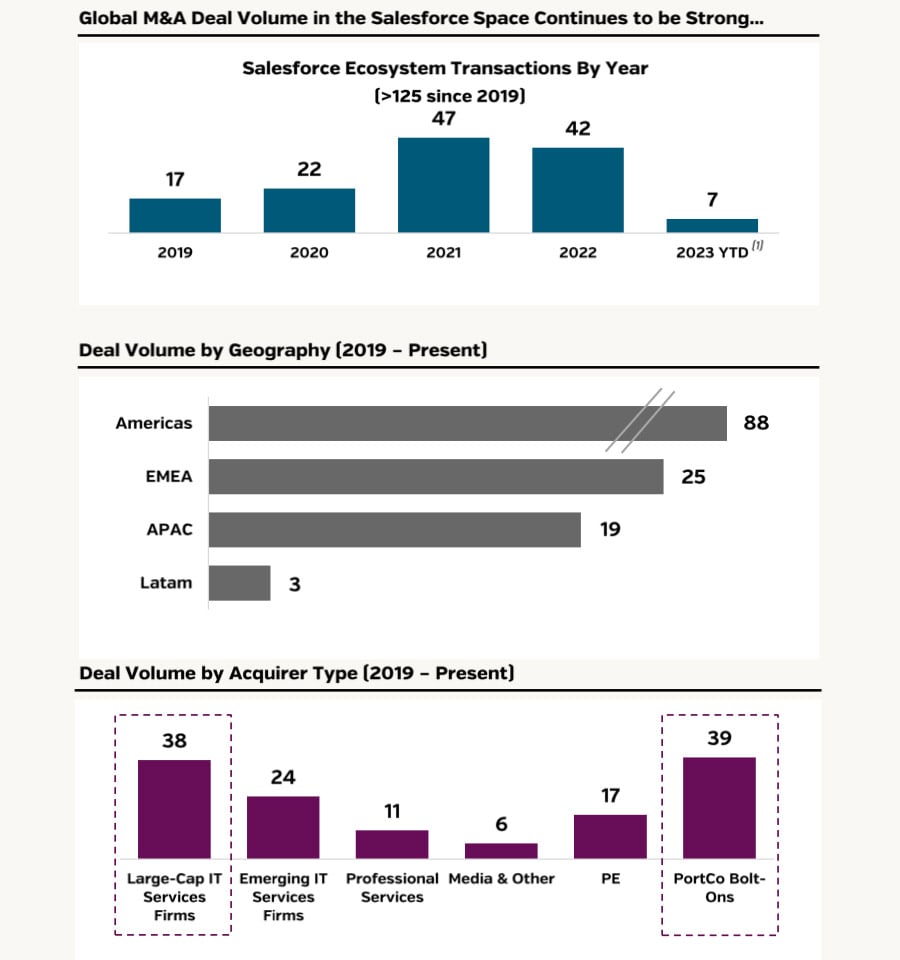

Partners within Salesforce’s ecosystem subsequently find themselves in keen demand. While the number of transactions did fall from 47 in 2021 to 42 in 2022, the figure still represents a peak for the sector – which saw just 17 deals in the year prior to the pandemic. According to Equiteq, activity remains highest in the world’s most developed economies – with 88 of the deals since 2019 coming from the Americas (chiefly the US), and 25 coming from the EMEA region (chiefly Europe), including Pexlify joining Dentsu Group.

Again, Equiteq maintained that heightened private equity and private equity-backed demand was key to the continuing popularity of deals for Salesforce partners. Portfolio companies – funded by private equity firms – make up 39 of the deals to have occurred in the space in the last three years, the highest number of any buyer type. As the fundamentals of Salesforce partners remain strong in 2023, this demand may well continue, leading to another healthy year of M&A activity.

The article was written by Consultancy.uk.

Download and read Equiteq's Adobe Ecosystem Report 2023

Download and read Equiteq's Salesforce Ecosystem Report 2023